south dakota property tax exemption

Constitutional Provisions There are two sections in the South Dakota Constitution that provide property tax exemptions. Why doesnt South Dakota have net metering.

California homeowners 65 and older should check their property tax bills and make sure they are getting any senior exemptions on school parcel taxes to which they are entitled.

. The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax SDCL 10-4-42 to 10-4-45. Appropriate communication of any rate hike is also a requisite. This program exempts up to 150000 of the assessed value for qualifying property.

The product or service is specifically exempt. Article XI 5 provides a property tax exemption for property of the United States and of the state county and municipal corporations both real and personal Article XI 5 is self-executing and needs no statutory language to put the. Taxation of properties must.

Thats what were used to seeing in a property tax exemption. Tax-wise South Dakota is one of the best states for retirees. 86-272 or the Interstate Income Act of 1959 a federal law designed to protect businesses from income tax liability in a state where they have no property or employees.

The MTCs new interpretation pretends to adhere to the. South Dakota agricultural property owners with riparian buffer strips a vegetated area near a body of water have until October 15 to apply for a property tax incentive. The first 50000 or 70 of the assessed value of the property used for producing solar power ie your home whichever is greater is.

This is a multi-state form. Parcels of exempt property listed in the table. In addition to no state income tax.

The state that is due tax on this sale may be notified that you claimed exemption. South Dakota then takes it one dramatic step farther. If you have questions about the eligibility of your land.

South Dakota offers special benefits for Service members Veterans and their Families including a property tax exemption for Veterans and their Surviving Spouses compensation for state active duty education assistance license plates hunting and fishing benefits and free or reduced fees at South Dakota State Parks. Additionally the disability has to be complete and 100 related to military service. SDCL 10-4-40 and 10-4-41states that 150000 of the full and true value of a dwelling that is owned and occupied by a veteran who is rated permanently and totally disabled from a service connected disabilityies is exempt from taxation.

Most require seniors to apply by a certain date often in May or June to get an exemption for the tax year that starts July 1. Unless otherwise noted filers may exempt the full value of the following personal. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser.

Learn more about south dakota property tax exemption for paraplegic veterans and their surviving spouse. The Property Tax Division is responsible for overseeing South Dakotas property tax system including property tax assessments property tax levies and all property tax laws. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that is due tax on this sale.

The property subject to this exemption is the same property eligible for the owner-occupied classification Learn more about this program in our Disabled Veteran Property Tax Exemption Brochure PDF. There are two sections in the South Dakota Constitution that provide property tax exemptions. While maintaining statutory restraints mandated by statute the city establishes tax levies.

South Dakota law doesnt provide many personal property exemptions but you can use the wildcard exemption explained in greater detail below to exempt additional personal property including equity in your motor vehicle and tools of the trade necessary for your profession. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be held taxable unless specially exempted. The dwelling must be owned and occupied by the veteran.

Summary of South Dakota Military and Veterans Benefits. Exempts up to 150000 of the assessed value for qualifying property. Click to see full answer.

Homestead the equity in your home is protected if the property is under one acre in a town or. The property has to be their principal residence. Property Tax Exemption for Disabled Veterans.

Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes. What will I get paid from my utility for my excess generation. Not all states allow all exemptions listed on this form.

The Property Tax Division plays a critical role in ensuring that property. Pdf California recently decided to become the first state to follow the Multistate Tax Commission MTC in its new interpretation of PL. All sales of tangible personal property and services are subject to the state sales tax plus applicable municipal tax unless exempt from sales tax.

Application for the exemption is made through the county assessor. If you are a homeowner in Alaska and over the age of 65 youll get a municipal property tax exemption on the first 150000 of your homes value. Entering into this program makes the applicant not eligible for the Property and Sales Tax Refund Program.

There are three reasons why a sale may be exempt from sales or use tax. For example on a 250000 property in Alaska you would pay 3000 annually at a tax rate of 3. Article XI 5 provides a property tax exemption for property of the United States and of the state county and municipal corporations both real and personal Article XI 5 is self-executing.

Eligible waterways are determined by the Department of Agriculture and Natural Resources with additional waterways as allowed by the county commission. The purchaser is exempt. Wind solar biomass hydrogen hydroelectric and geothermal systems used to produce electricity or energy are considered renewable resource systems.

South Dakota property tax credit. South Dakota Property Tax Exemption South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. Property taxes are the primary source of funding for schools counties municipalities and other units of local government.

The property subject to this exemption is the same property eligible for the owner-occupied classification To be eligible. A major reason for the high tax payments here is that lincoln county also has the highest median home value in the state of 218400. You must be 70 years of age or older or the surviving spouse of someone previously eligible.

The property must be owned and occupied by a disabled.

Property Tax Comparison By State For Cross State Businesses

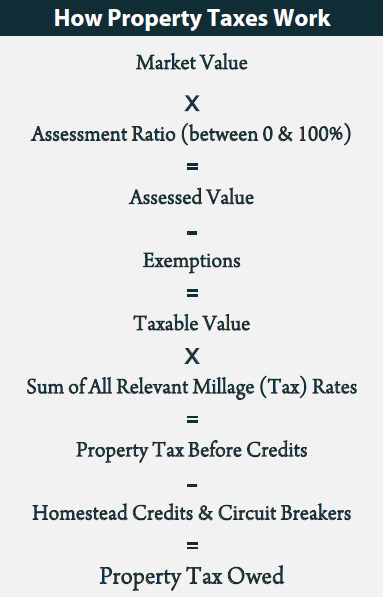

Property Tax Definition Property Taxes Explained Taxedu

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Property Tax Definition Property Taxes Explained Taxedu

New Form Released For Surviving Spouse Lod Homestead Property Tax Exemption Contact Your Support Coordinator With Q Supportive Property Tax Homestead Property

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations

New Ag Census Shows Disparities In Property Taxes By State

Property Tax Definition Property Taxes Explained Taxedu

Property Taxes How Much Are They In Different States Across The Us

The Best States For An Early Retirement Early Retirement Life Insurance For Seniors Life Insurance Facts

Relief Programs South Dakota Department Of Revenue

Solar Property Tax Exemptions Explained Energysage

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Property Taxes By State In 2022 A Complete Rundown

Understanding Your Property Tax Statement Cass County Nd

The United States Of Sales Tax In One Map Map States Federal Taxes

Own And Occupy A House In South Dakota A Deadline To Save On Taxes Is Approaching

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)